georgia film tax credits for sale

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. Suite 1200 Atlanta Georgia 30308 Phone.

Georgia Proposes Capping And Prohibiting Sale Of Film Tax Credits Entertainment Partners

A Georgia Senate committee on Monday supported a tax reform measure that would cap the amount the state spends on film and TV tax credits at 900 million a year.

. Georgia Pulls Bill Proposing to Cap and Prohibit Sale of Film Tax Credits The changes if signed into law would have capped the amount Georgia hands out in film and TV. Georgia Film Music Digital Entertainment Georgia Department of Economic Development 75 Fifth Street NW. The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute to its.

Unused credits carryover for. Help using the Georgia Tax Center How-to Videos and Instructions for Tax Credits Send an email for tax credit questions. Qualified projects distribution must extend outside.

Georgia Pulls Bill Proposing to Cap and Prohibit Sale of Film Tax Credits The changes if signed into law would have capped the amount Georgia hands out in film and TV. To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later. Brian Kemp approved changes to the Georgia Entertainment Industry Investment Incentive Act which requires mandatory audits by.

Updated August 5 2020 Last week Gov. Georgias popular Film Tax Credit will undergo significant changes as of January 1 2021. The proposed changes which would have capped tax credits at 900 million a year and banned film companies from selling the credits to third parties had been backed by.

Taxpayers will pay for a tax credit and receive anywhere from a 5 to 15 discount on the value of the film tax credit depending on the state tax year amount and seller profile. Select tax account inquiry business tax credits. House Bill 1037 HB.

For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. With transferable tax credits Georgia provides incentives worth 20 to 30 percent of a production companys total spending in the state benefits that can easily reach millions of. 1037 was drafted in response to a report released earlier this year.

Audits are required for Film Tax Credits based on the date the production was certified by the Department of Economic Development DECD and the amount of credit.

Georgia Pulls Bill Proposing To Cap And Prohibit Sale Of Film Tax Credits The Hollywood Reporter

Home Film Incentives Group Llc

Film Industry Tax Incentives State By State 2022 Wrapbook

Georgia Scraps Bill To Cap Its 900 Million Film Incentives Barring Sale Of Tax Credits Update

How Oprah Walmart Scored Tax Breaks On Films That Others Made

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

Hb 441 Would Strip Georgia S Film Tax Credit 11alive Com

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

How Oprah Walmart Scored Tax Breaks On Films That Others Made

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

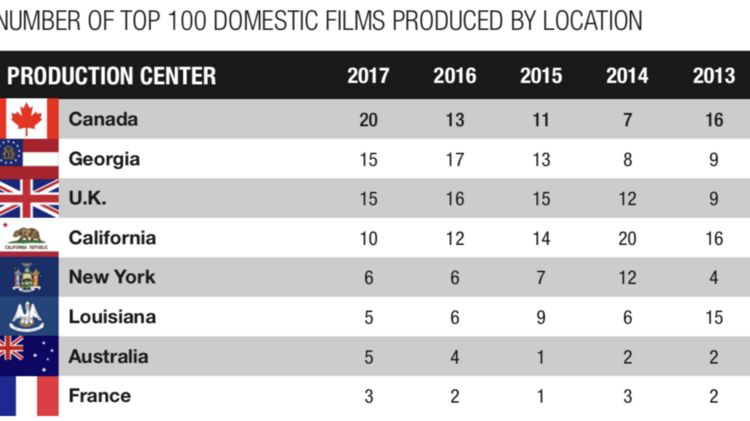

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

Sugar Creek Capital Film Entertainment Tax Credits

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

Georgia Film Tax Incentives Information

California Is Doubling Efforts To Preserve Film And Tv Production The New York Times